FAQ

- Home /

- FAQ

Estate planning involves making arrangements for the management and distribution of your assets during your life and after your death. It includes creating legal documents like wills, trusts, powers of attorney, and healthcare directives to ensure your wishes are followed and your loved ones are taken care of.

An estate plan provides clarity and direction for the distribution of your assets, reduces the burden on your loved ones, minimizes estate taxes, and helps avoid potential legal disputes. It also ensures that your wishes regarding your health care and finances are respected if you become incapacitated.

Without an estate plan, your assets will be distributed according to state law, which may not align with your wishes. This process can be lengthy, costly, and may lead to conflicts among your heirs. Additionally, without a healthcare directive or power of attorney, decisions about your health and finances could be made by someone you did not choose.

A will is a legal document that outlines how your assets will be distributed after your death. It also allows you to name a guardian for your minor children and an executor to manage your estate. Having a will ensures your assets go to the people you choose and can help avoid probate court.

A will takes effect after your death and must go through probate, a legal process that can be time-consuming and expensive. A trust, on the other hand, can take effect during your lifetime and after your death, allowing for the management and distribution of your assets without going through probate. Trusts also offer privacy, as they are not public records.

Probate is the legal process of validating a will and distributing assets according to the will or state law if there is no will. It can be time-consuming, expensive, and public. Probate can often be avoided by setting up a trust, designating beneficiaries on accounts, and holding property jointly.

A power of attorney is a legal document that grants someone you trust the authority to make decisions on your behalf if you are unable to do so. This can include managing your finances, making healthcare decisions, or handling other legal matters.

An advance healthcare directive, also known as a living will, is a legal document that outlines your wishes for medical treatment if you become unable to communicate them yourself. It can also designate someone to make healthcare decisions for you.

You should review and update your estate plan regularly, especially after major life events such as marriage, divorce, the birth of a child, or the death of a beneficiary. It’s also a good idea to review your plan every few years to ensure it still aligns with your wishes and current laws.

Yes, you can modify your estate plan at any time, as long as you are mentally competent. This includes updating your will, adding or removing beneficiaries, changing your designated executor or trustee, and revising your healthcare directives.

While it’s possible to create basic estate planning documents on your own, consulting with an experienced estate planning attorney is recommended. An attorney can help ensure that your documents are legally valid, customized to your needs, and that your estate plan is comprehensive and effective.

There are several strategies to reduce estate taxes, including gifting assets during your lifetime, setting up trusts, and taking advantage of estate tax exemptions. An estate planning attorney or financial advisor can help you explore options to minimize taxes on your estate.

Digital assets, such as online accounts, social media profiles, and digital files, should be included in your estate plan. You can designate someone to manage these assets after your death and provide instructions for how they should be handled.

A beneficiary designation is a form you fill out for financial accounts, life insurance policies, and retirement plans, naming who will receive the assets after your death. These designations supersede instructions in your will, so it’s important to keep them up to date.

There are several strategies to protect your estate from creditors, such as setting up certain types of trusts, transferring assets to your spouse, or using life insurance. An estate planning attorney can help you implement these strategies effectively.

Choose someone you trust, who is organized, responsible, and capable of managing your estate according to your wishes. It’s important to discuss your choice with them to ensure they are willing and able to take on the role.

In your will, you can name a guardian for your minor children, ensuring they are cared for by someone you trust. You can also set up a trust to manage their inheritance until they reach a certain age.

Charitable giving in estate planning involves including donations to charities in your will or trust. This can provide tax benefits and allow you to support causes you care about even after your death.

Start by taking an inventory of your assets, considering your goals, and deciding who you want to inherit your property. It’s also important to think about who you trust to make decisions on your behalf. Then, consult with an estate planning attorney to create a plan that fits your needs.

The cost of estate planning varies depending on the complexity of your situation and the services. It’s best to discuss fees with your attorney upfront.

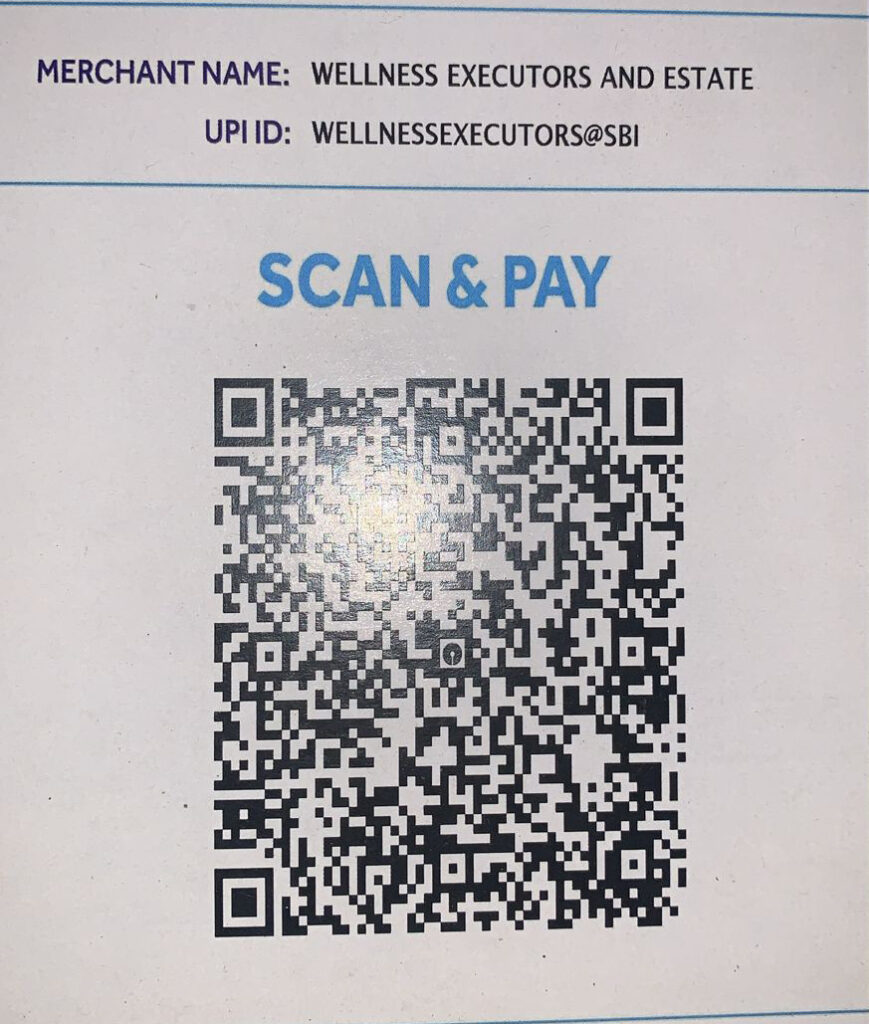

Wellness Executors and Estate Managers Pvt Ltd

State Bank of India, Mumbai Main Branch,

Current A/c 36116751789

IFSC 0438200046

WhatsApp us